Tijuana Industrial Real Estate Current Inventory February 2017

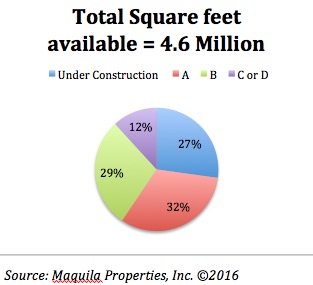

Total Market as of February 2017 – 65 million square feet Total Available as of February 2017 – 2 million square feet Vacancy Rate as of February 2017 – 3.25% Rarely are buildings for sale in Mexico, therefore the vast majority of Maquilas are 3, 5 and 10 years lease terms. Most Class A buildings.. read more →

Tijuana Industrial Real Estate Update February 2017

Tijuana Industrial Real Estate Update February 2017 Tijuana is in a state of flux. Looking at thirty years of data while working in this market, there has never been so little vacancy. In 2016, over four million square feet was absorbed by companies like Motor Car Parts & Accessories and Flextronics. Today, given some of.. read more →

2016 Mexican Industrial Real Estate – A View of Mexico’s Maquiladora Market

The borders of Mexico were the first beneficiaries of the maquiladora (or in bond) program in the 1960’s. Foreign companies could import machinery and raw materials duty free, as long as they promised to re-export the final products. The Maquila Program or Border Industrialization Program, was intended to provide jobs for guest workers left unemployed.. read more →

Tijuana Real Estate Update 1st Quarter 2016

The Tijuana commercial and industrial real estate market is booming. Vacancy has dropped to 5% for the first time since the 1990’s. The Tijuana Industrial real estate market boomed in 2015 as Flex Medical (144,000 SF in Otay), Ink Throwers (200,000 SF in La Jolla Industrial Park), Jonathan Louis Furniture, (155,000 SF in El Aguila).. read more →

Macquarie Mexico Expands its Commercial Real Estate Portfolio

FIBRA Macquarie México announced it has successfully completed the acquisition of a ten-property industrial portfolio with a Gross Leasable Area (GLA) of 2.2 million square feet located in the northern Mexico cities of Monterrey, Reynosa, Tijuana, Ciudad Juarez and Saltillo. The portfolio was acquired from an institutional industrial property owner and developer in Mexico for.. read more →

Northwest Mexico Commercial Real Estate Market September 2012

Northwest Mexico Commercial Real Estate The Northwest Mexico Commercial Real Estate Market When the US sneezes -‐ the old saying goes – Mexico catches a cold. After Mexico caught bird, flu, was ravaged by a drug war, was priced out of low end manufacturing by China, and witnessed the decimation of its biggest export market,.. read more →

Tijuana Commercial Real Estate Market

The Tijuana Commercial Real Estate Market September 2012 Where are the opportunities and what are the risks? Economy When the US sneezes-- the old saying goes – Mexico catches a cold. Even after Mexico caught bird flu, was ravaged by a drug war, was priced out of low end manufacturing by China, and witnessed the.. read more →

Tijuana Commercial Real Estate Q1 2012

Tijuana Commercial Real Estate Q1 2012 read more →

Tijuana industrial real estate update 3rd quarter, 2011

Tijuana industrial real estate update 3rd quarter, 2011 Highlights: • Slow absorption this quarter – Only 112,000 SF Net. • Asking rents are still dropping (Class A as low as $0.29/SF !). • Tenants are moving out of older higher priced buildings into newer buildings. • Logistics suppliers are losing business as companies use excess.. read more →

2011 Q3 SUMMARY – Tijuana Industrial Real Estate

Tijuana Industrial Real Estate Update Tijuana Industrial Real Estate 2011 Highlights: • Slow absorption this quarter – Only 112,000 SF Net. • Asking rents are still dropping (Class A as low as $0.29/SF !). • Tenants are moving out of older higher priced buildings into newer buildings. • Logistics suppliers are losing business as companies.. read more →